Is The ‘Tampon Tax’ and argument of gender inequality or economics?

The ‘tampon tax’ has been abolished from the United Kingdom… what about the United States?

Over the centuries women have fought long and hard to omit gender inequalities in every aspect of our lives. The suffragette movement brought about the right to vote, one of the biggest achievements for women’s rights, and was also a catalyst for many other opportunities for women to shine and show their true worth as a person, not what gender they identify with. Over the years, although, women’s rights have been at a standstill and although there have been small changes towards equality there is still a divide.

One of the divides is known as the ‘tampon tax’ which is a tax put on any feminine hygiene products and usually ranges around 5%. Recently, at the start of the new year, the United Kingdom has abolished the tax. They are now apart of only a small group, eight countries, to have the tax fully abolished. Why is this?

Well, the United Kingdom was only able to abolish the tax when they were no longer apart of the European Union (EU). The EU mandates the value-added tax and the biggest reason for this, is strictly based on revenue.

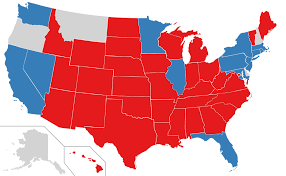

So what about the United States? The United States government does not have a federal tax on feminine hygiene products, rather, it is up to the states. There are currently eleven states out of the fifty that do not have the tampon tax.

The argument as to whether or no the ‘tampon tax’ should be continued or not is more of an economic issue. California stated that if they were to forego the tax, they would lose $20 million in one year, which could lead to higher taxes on other products. New York, which is one of the states to have abolished the tax reported a $14 million revenue loss.

What would be the solution? I believe that the ‘tampon tax’ should be abolished because it is not a luxury item, but rather it is a necessity. However, food is also a necessity so you could argue that there should be no taxes on food as well.

I believe that the tax on feminine hygiene products should not be labeled as a tax on products geared to those who menstruate as it becomes subjective and degrading that women have to pay extra on already costly items to help control something out of their control.

Overall, the argument is not to rid all states of the ‘tampon tax’ if it leads to other economic struggles but to change the label and stop creating a divide between men and women in all aspects of life.

Hi! I'm Zoe and am a senior at Oakton High School. I have been on the Outlook since my freshman year and am so excited to be an editor-in-chief this year....