New York Times releases President Trump’s tax returns

Breaking down the important pieces with Oakton’s AP Economics teacher, Ms, Lawver

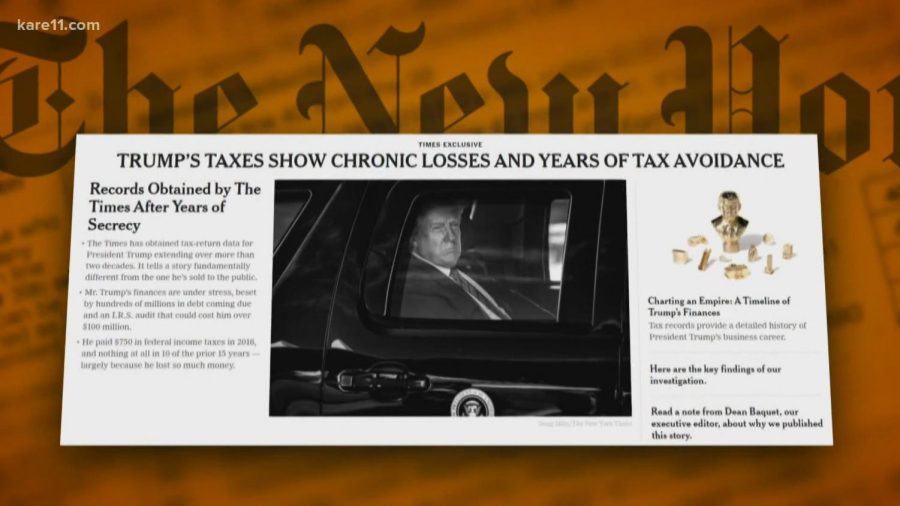

On September 27th, 2020 the New York Times released 18 years of President Trump’s tax returns to the public, revealing shocking information. Since Trump’s first presidential bid in 2016, he has been adamant about hiding his tax returns. He claims that since he is under audit he cannot release them, which has been proven by many as incorrect. The tax returns show years of losses and bankruptcy’s from his failed businesses, multi-million dollar loans that are due to be repaid soon, and that he paid a total of $750 in income taxes in 18 years. Here are some of the most important and shocking details from the tax returns broken down by AP Economics teacher, Ms. Lawver:

How was President Trump allowed to only pay $750 in taxes in 18 years?

“If a person can claim enough expenses then any gross profits would be canceled out and their income taxes would be significantly lowered or in Trump’s case not pay any at all for a number of years.”, Ms. Lawver said. A lot of Trump’s businesses might have a lot of business expenses and he was able to write them off and get tax deductions. The $750 in taxes he paid in total from 2016 and 2017, was the leftover from what he made and his expenses which ended up being the money he owed to the government in taxes.

Regarding the money, Trump makes as President and whether he had to pay tax on that Ms. Lawver says that “Although the president’s salary is in the upper tax bracket, Trump only takes $1 from the $400,000 salary he gets as a president and donates the rest to different governmental agencies. He only has to pay tax on the $1. The taxes he paid are more likely from his other business since he has not put his business in a blind trust, which is when someone gives their business to someone else to run so they don’t have influence nor can they make money from it.” Many modern-day presidents have begun doing this as a way to prevent a conflict of interest, but Trump has not done this is, which is why he had to pay taxes from his businesses, as president.

How was he able to get a tax deduction on expenses such as getting his hair done, purchasing houses, and travel?

Ms. Lawver explained that before the final assessment is made about how much you owe in taxes they look at the gross wages and Trump could have claimed that some of it was used for his “look” as a TV personality. That is where those tax deductions likely came from.

How was Trump allowed to get a 72.9 million dollar tax refund from the IRS?

Trump’s business losses were so great that any money he paid to the government was in the negative so the government ended up having to pay him. Ms. Lawver emphasized that to have a 72.9 million dollar tax refund there would have had to be an extensive amount of losses.

He has 400 million dollars in loans that are due in 2022. What does that mean for his financial status? What if he cannot repay them?

Ms. Lawver elucidates, “Him not being able to the loans indicates he is insolvent and bankrupt. You cannot write off a loan, if the business fails then you have to write the loss off to the federal government. He has multiple businesses under the Trump name, if he cannot pay it back then he can declare bankruptcy with the business which he owns the loan from, or end up paying pennies to the dollar, which the bank will take because it is better than not getting any money” For a normal person, declaring bankruptcy stays on your record for seven years, but since Trump owns many businesses under his name, one bankruptcy doesn’t necessarily impact him as much because he has other businesses to fall back on.

Hey! My name is Sahithi Jammulamadaka and this is my fourth year on the Oakton Outlook staff and my second year as Editor-in-Chief! I am super involved...